The last time that AMD and Intel were actually competitive, it was all about AMD and Intel. And it didn't really last all that long; AMD was already behind the performance curve by the time it launched the successor to the wildly successful Athlon64. How things have changed! But Intel isn't taking it lying down. Here's a detailed look at where things are headed.

Now that AMD has successfully launched its third Intel beating product in a row, Intel is finally starting to wake up. And at the same time, we have a three-way battle brewing between nVidia, Intel, and AMD on the GPU side.

The first bit of news is Whitley, Intel's Ice Lake server processor, based on the new 10nm Sunny Cove architecture. In addition to having a new processor architecture, memory controller, and 11th generation GPU, it's also the first CPU with an integrated Thunderbolt 3 controller. Preliminary benchmarks show it achieving close to a whopping 100% performance improvement per core (and per clock) over the latest iteration of the aging SkyLake processor architecture.

Intel hasn't revealed any details of its Ice Lake architecture yet, and this is just a preliminary benchmark so it definitely requires a grain of salt. However, if the preliminary benchmarks are even in the ballpark of accurate, then Whitley will be a strong contender.

The consumer Comet Lake CPUs are expected soon as well using the same architecture, requiring a new LGA 1200 socket, so the new processors will also require new motherboards.

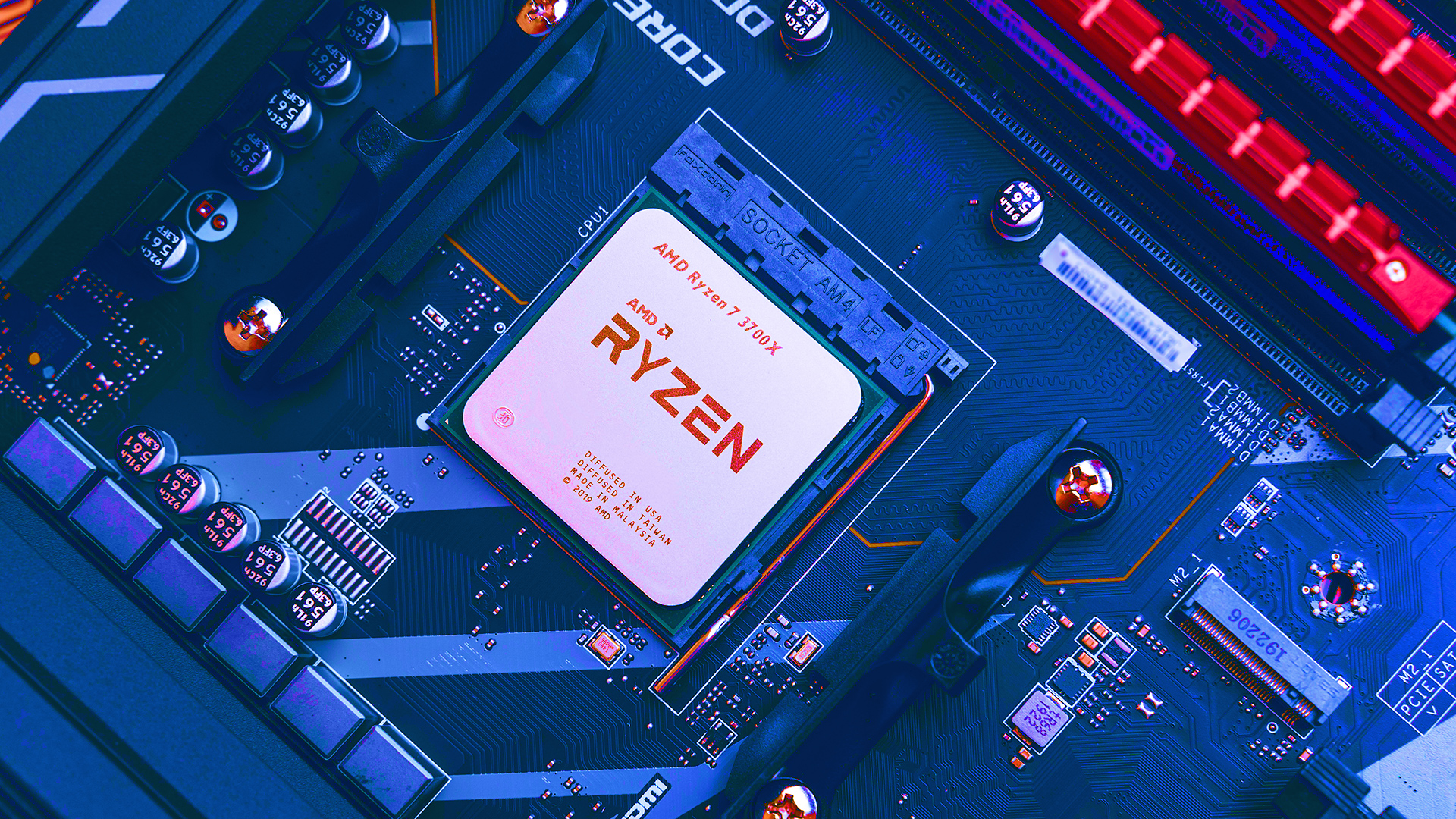

Zen3

AMD of course has its Zen3 architecture on track for launch, as long as the coronavirus outbreak doesn't cause excessive disruption. It's promising to deliver a significant improvement in per-clock performance along with improved efficiency from the combination of moving from TSMC's 7nm process to its 7nm+ process using extreme ultra-violet lithography.

Under Lisa Hsu's leadership, AMD has been making its plans based on the assumption that Intel would execute according to plan, and has been using those plans to determine what performance levels it will require in order to compete head to head with Intel. AMD's response to Intel's problems has been to keep going as planned, rather than slowing down and taking advantage of the opportunity to sell more current generation parts. As a result, it's likely that AMD will be able to retain a performance lead.

Next up is Intel's Xe, with its first benchmarks showing as much as a 40% lead over the AMD Vega used in AMD's upcoming Renoir APU. That bodes well for Intel's prospects at competing in the GPU and the mobile space with its new CPU and GPU architectures.

Intel has also unveiled tentative plans for an Xe GPU with a whopping 500 watt power draw. While on the surface that seems rather crazy, on closer inspection it's actually rather exciting; it's a monster of a GPU based on four Xe tiles each of which has 512 execution units, leading to an estimated total of over 16,000 compute cores and a peak throughput of 36 teraflops. For that amount of computing power, 500 watts is actually quite impressive. Being based on the Xe HP (high performance) line, Arctic Sound is probably also a 2021 product rather than 2020.

Radeon

AMD has put 7nm+ Radeon GPUs through certification, though it's not clear yet whether these are updated versions of the current Navi or the next generation Navi that we got a taste of during Microsoft's Xbox Series X reveal. AMD isn't likely to be able to catch Ampere in 2020, but the console sales alone will make a lot of money for the Radeon Technologies Group. What AMD has revealed is that RDNA2 will include hardware ray tracing and variable rate shading, use TSMC's 7nm+ EUV lithography, and include GDDR6 or HBM2 memory depending on the model.

Being the only one of the trio without a significant stake in the CPU market since the only significant customer nVidia has for its ARM CPUs is... nVidia, its strategy is markedly different. Nvidia has no integrated CPU+GPU products, so it can't compete nearly as effectively in the largest volume GPU segment as Intel and AMD can.

Nvidia has been continuing to make bigger and bigger inroads into the datacenter and AI markets, where it's continuing to grow. It's also no stranger to high-performance computing, as evidenced by its Big Red contract, a supercomputer that Indiana University is building around Shasta supercomputer modules. It's going to use AMD's Rome processors, and IU has chosen to go with a phased launch.

Tesla?

Instead of the Tesla GPUs it was planning on using, it's going to launch a CPU only version now and then add the GPUs using the next generation version, citing a 75-100% improvement in tensor performance over the current Teslas. Another area where nVidia has been continuing to gain ground is in computer vision; nearly every self-driving and assisted car on the market has an nVidia SOC in it, as do devices like Skydio's new Skydio 2 autonomous drone. Nvidia has already announced its first Ampere based product, the Orin SOC that combines ann Ampere GPU with 12 ARM Hercules CPU cores designed for autonomous vehicles and similar AI and computer vision based applications.

During its quarterly financials conference call, CEO Jensen Huang mentioned a reveal planned for the GPU Technology Conferent (GTC) in March, saying very little beyind “You won't be disappointed.” Because GTC is datacenter and AI focused, we'll have to wait until NAB, the Electronic Entertainment Expo, or SIGGRAPH to get the real scoop on gaming and workstation GPUs based on Ampere. Since nVidia is still leading the high end of the GPU market in spite of using a 12nm fabrication node, the expected move to 7nm EUV lithography is big. Nvidia has hinted at a 75% increase in performance and doubled power efficiency, but hasn't revealed any details yet.

Since AMD has outsourced its fabrication to TSMC and is slated to be TSMC's biggest 7nm+ customer this year, it's not going to be held back from taking market share from Intel like it was during the Athlon64 and Opteron heyday. That alone will make the competition between them more interesting then ever before, but the addition of the three way war in the GPU market will spice things up quite a bit.

Tags: Technology

Comments