There is usually a summer dip in shipments of cameras from the major Japanese manufacturers, but the latest CIPA data shows this year's slump to be more pronounced than most.

CIPA's camera shipment reports are closely followed by many worldwide as it has long provided an accurate bellwether of how the industry is doing given that so many of the major players are based in Japan.

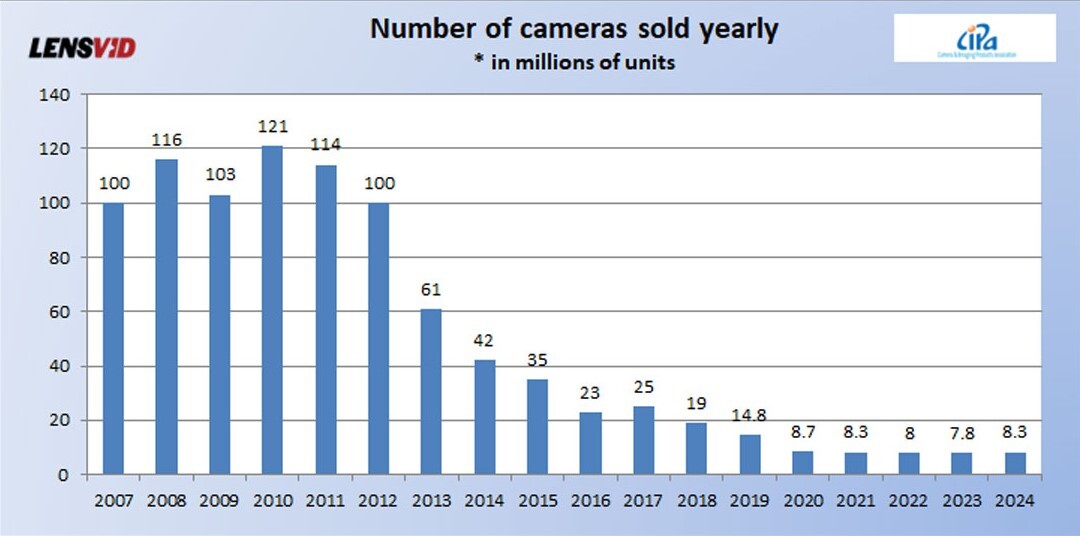

Back at the start of the year, this was a cause for much optimism as the full figures for 2024 showed the first annual increase in shipments since 2017* (we ran a parallel story about the growth of the creator economy leading to the boom using other data). And while 2025's figures to date are above where 2024's were year on year, optimism gives way fairly rapidly to concern when you see the size of the 2025 summer slump shown in orange below.

![The image shows a line chart titled 'Quantity of Total Shipment of DSC [Worldwide] Comparison of 2023, 2024 and 2025 -Jan.-Aug.'. It compares the total shipment quantities of DSC (Diesel/Gasoline Special Cargo) over the months from January to August for the years 2023, 2024, and 2025. The chart includes a legend indicating that the line for 2023 is a solid line, 2024 is a dashed line, and 2025 is a dotted line. Below the chart, there is a table providing the exact figures for each month and year. The x-axis represents the months from January to August, and the y-axis represents the quantity in thousand units.](https://www.redsharknews.com/hs-fs/hubfs/cipa%20summer%202025%20data.png?width=2126&height=1614&name=cipa%20summer%202025%20data.png)

What the Data Shows

The key word here is 'tariffs'. Trump delivered on his election promises and the US announced that tariffs were coming in April. It looks like manufacturers then ramped up shipments to both a) meet the demand for people looking to buy new gear, and b) to get stock into the US before before they were imposed. That accounts for the spike in April and May and the rapid decline in August.

Shipments of interchangeable lens cameras seem to have been particularly badly hit. Digging into the data a little bit more and trying to dial out the peaks and troughs of the US shipments, though, there also seems to be a definite weakness in both the Chinese and the European markets that were unaffected by tariffs — at least directly.

The precise causes of these regional slumps are unclear, with analysts citing factors ranging from European heatwaves to global political instability and broader economic uncertainty.

September Figures Are Key

What is important is what happens next. In previous years, September has seen the start of a recovery that accelerates into the holiday season as sales ramp up through Black Friday and beyond. But previous years have not had a simmering global trade war to contend with, so all bets are off the table.

As Canon Rumors points out, as it stands we're ahead of the game still. The camera market is experiencing an 8% growth in shipments for interchangeable lens cameras and close to 14% for built-in lens cameras. So, there is headroom in there. But the rebound is going to have to be strong one and with the US tariffs we are currently swimming in uncharted waters.

*Up to 8.37 million units. This LensVid table shows how much the industry has contracted since the introduction of the smartphone.

Tags: Production Cameras CIPA

Comments